Source: RADAR | February 8, 2018 | Trey Cowan

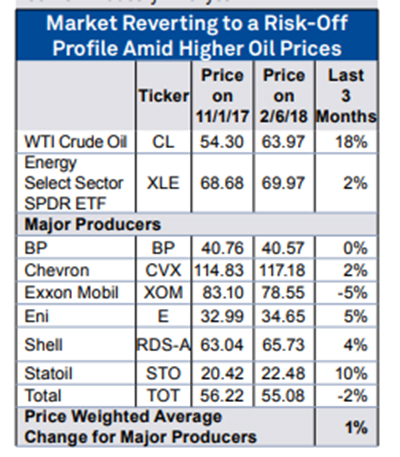

Spot prices for WTI crude are up 18%, or $10 per barrel, over the past 3 months. But you would not know this by looking at how the equities of major producers have performed over the same time span. The majors (which we define as BP, Chevron, Exxon Mobil, Eni, Royal Dutch Shell, Statoil, and Total) have shown only a 1% average improvement in their stock prices during the last 13 weeks.

And, slightly alarming, we note that ExxonMobil (XOM) has seen its share price fall by 5% over this same period. Some explanation for this correction may come from the fact that while liquids volumes for the company grew domestically during 2017 (with a majority of this production derived from the Williston, Delaware, and Midland basins), the overall production on an annual basis fell 2% from 2016 levels. The drop in total production volumes was due to field declines, lower entitlements, and asset sales. Additionally, 4Q17 overall earnings for XOM, which were reported last week, fell short of Wall Street expectations and are weighing on its stock price too.

A silver lining for industry watchers focused on the domestic oilfield services landscape, however, can be found in XOM’s 4Q17 conference call. ExxonMobil expects to ramp up its domestic drilling program by 20% to 36 rigs by yearend. Within these plans the company expects to use 30 rigs in the Permian Basin and the remainder in the Bakken Shale. We also note that XOM continues to successfully push the boundaries via optimizing well design through the use of extended laterals. The company anticipates drilling about 20–30 three-mile horizontal wells in the Bakken during 2018.

Chevron’s 4Q17 earnings per share were also underwhelming relative to Wall Street’s expectations. But they also expressed comments that were similar to Exxon’s sentiments surrounding tight oil projects. Specifically, Chevron has experienced significant production growth in the Permian (up 35% yearover-year) from its 16 drilling rigs and 6 frac spreads deployed during 2017. For 2018 the company anticipates building its drilling fleet out to 20 rigs, or a 25% ramp-up vs. existing levels. So both of these majors are likely to increase their US onshore production volumes.

This brings us back to the paradox of why disciplined majors such as Chevron and ExxonMobil, which are expecting increased activity and growing production (in a higher-price environment than 2017’s) are not experiencing better stock performances? Besides the broader market’s flight rebalancing away from volatile investments and the weaker than expected 4Q17 results published so far, we believe that investors in energy equities are reacting cautiously to the backwardization in futures contracts for both oil and natural gas prices.

However, given the fact that global inventory levels have been falling for the past year and a half consistently, we believe the futures market for crude oil contracts could revert to a more favorable outlook that will bring more investors back to the oil and gas industry. Furthermore, a better outlook for crude markets, if this does occur, will signal that overall energy consumption (i.e., demand) will increase its growth rate, ushering in a wave of greater demand for natural gas and thus higher prices for this commodity, too.

Excerpt from RADAR report. To find out more about this analytical report, contact Customer Service at 800-371-0083.