Article Written By: Trey Cowan, Sr. Industry Analyst at RigData

![Summary Statistics ]Summary Statistics](/images/default-source/default-album/treycowansummary.png?sfvrsn=0)

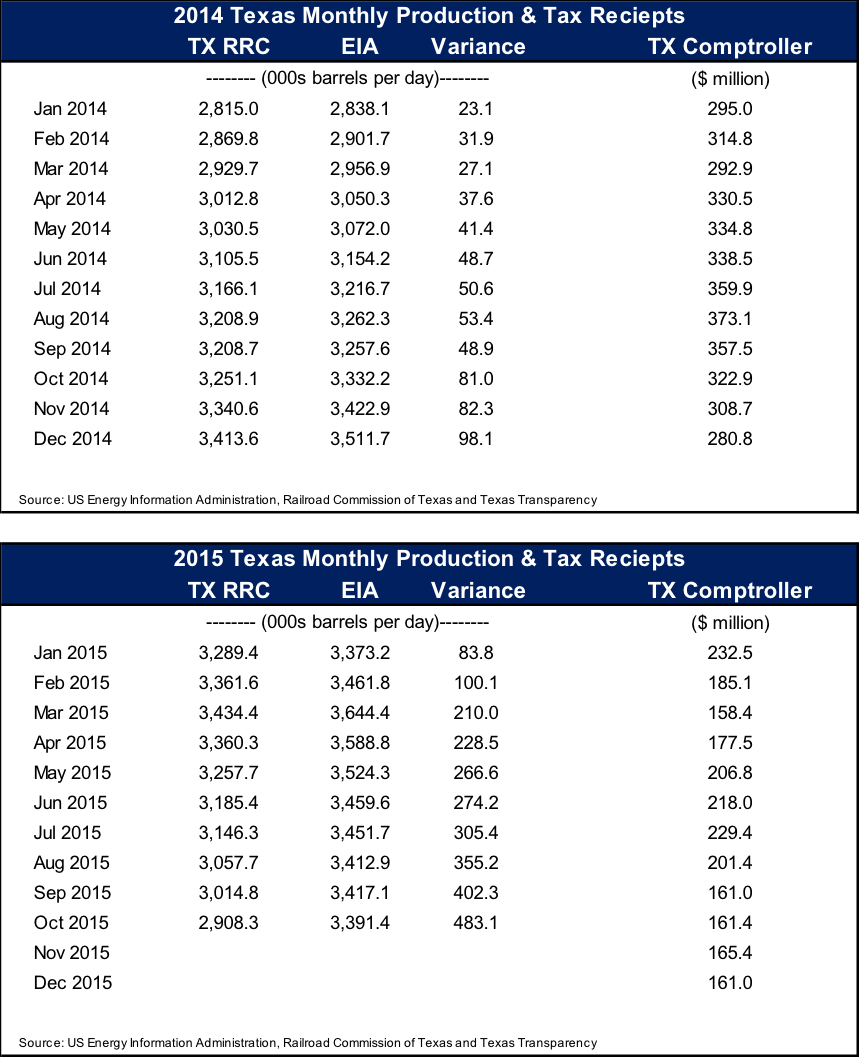

When it comes to reporting crude production (after presenting similar Texas monthly volumes for years), the Railroad Commission of Texas (TX RRC) and the US Energy Information Administration (EIA) have diverged in their representations. When viewed on a percentage basis, the spread between the two figures appears to be growing at an exponential pace annually. We know the catalyst for the divergence is recent changes to the EIA’s data collection methodology. Still, the question is “Should we believe the growing amount of overstatement (relative to the TX RRC) by the EIA for Texas is an accurate depiction of the state’s production?” As of October 2015, the gap between what the TX RRC and the EIA reported for crude oil & condensate average daily production widened to a 483 thousand barrels per day; nearly 6x wider than spread between these two figures one year ago!

Today, the EIA gathers monthly production volumes as reported directly from the operators, in order to mitigate the reporting lags it previously encountered from relying on data collection efforts by state agencies. Considering the recent widening discrepancy, we corresponded with the EIA and pointed out this divergence occurring with Texas production data. Their response to our questions was that the EIA’s new methodology collects about 90% of the actual data for monthly production from the operators, leaving only about 10% of their monthly production figures on a state by state basis up to chance. Reading between the lines the sentiment expressed in their replies was essentially that the EIA’s data collection is better than the various state agencies, in this case Texas. We do not hold the same confidence in the EIA’s data gathering techniques. Here is why:

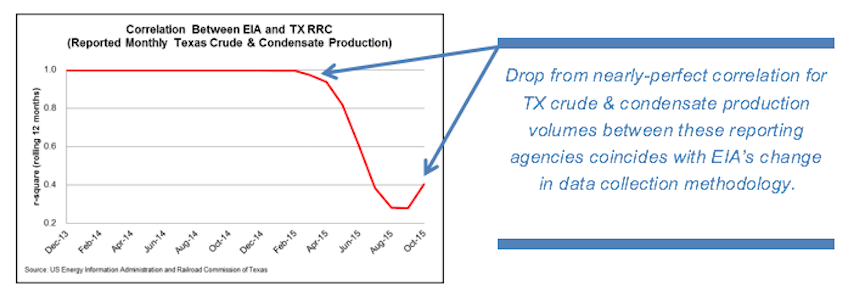

Seeing the relationship between two reporting agencies measuring the same item, in this case monthly crude & condensate production in Texas, fall from a near-perfect correlation to just a mediocre position triggers alarms. From a statistical perspective, we would have expected a degrading effect of r-square to better incorporate the time lag for some state-reported data (which the EIA has stated is approximately two years in Texas for some cases) and because they are both now not using the exact same sample data to reach their conclusions. But we did not expect this quick or steep of drop in correlation that occurred coincidental to the switchover. It is our belief that the dramatic decline in the relationship of these two data sets implies either a recent failure in sampling, testing, or both sampling and testing by one of the data collection agencies. Putting sampling or testing errors aside as explanations for the alarming drop, and without the luxury of seeing the actual data used to generate the EIA’s monthly average daily production figures, we would still wager that it is the EIA who is reporting erroneous findings. We base our opinion upon the precept that the simplest (fewest assumptions – Occam’s razor) and most obvious solution is generally correct. After all, the EIA did recently change their data-gathering methodology.

An alternative solution to either a testing or a sampling error is the interpretation of the data itself. We could easily come up with a scenario where the EIA could be double counting some barrels. For instance, well production that is shared among several operators (i.e., a gross versus net production reporting mismatch) could lead to some ambiguity over whether an operator is correctly responding to the data requests. Furthermore, this envisioned scenario could explain why the EIA’s reported average daily production figures in Texas continue to grow in their overstatement relative to what the TX RRC has reported. Because in this case, the additional barrels measured through this mix up would compound over time, if the operators reporting their results are consistent in their documentation procedures.

Tax Receipts Also Cast Shadow on the Results

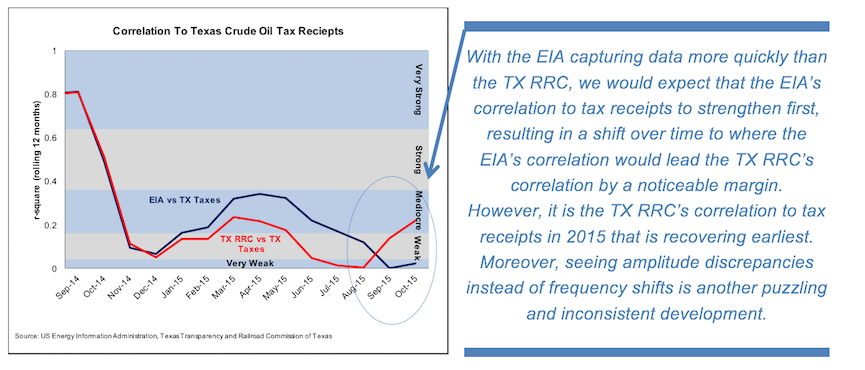

Prior to the decline in oil prices that began during the last half of 2014, a very strong correlative relationship existed between taxes collected by the Texas Comptroller for crude production occurring in Texas and monthly reported production volumes gathered by either the EIA or the TX RRC. Similar to the relationship between oil prices and the US land rig count (where the count responds in a delayed fashion to price swings), a lag also exists between changes to oil prices and future production volumes. This helps explain why the relationship between tax receipts (which are directly tied to commodity prices, in this case oil) and production volumes fell from very strong to very weak position over the past year. We note that the lag between the two (i.e., production volumes and tax receipts) is much longer in duration than the lapse between when rig counts react to changing oil prices. So, we would then anticipate that the currently weak relationship between tax receipts and oil production would begin to strengthen with the time-span being months instead of weeks once some oil price stabilization occurs.

What we see in these relationships is that the EIA and the TX RRC no longer are tracking one another in their correlation to tax receipts collected in Texas. Moreover, we would not have expected either’s correlation to production taxes to widen in disparity with one another to where one is now showing a mediocre relationship (TX RRC) while the other (EIA) remains in a very weak relationship. We believe this illustration is another example supporting our belief that there must be something else (other than the timing differences between producers reporting to each of the agencies) that is creating the discrepancy in production volumes compiled and published by the TX RRC and the EIA each month.