Source: Barrel Blog | John-Laurent Tronche, Managing Editor | November 30, 2017

The floodgates have opened. The game has changed. The possibilities are endless. This is the worst — absolutely.

Choose any of those expressions or phrases to explain some aspect of the global oil market — a market featuring US exports, OPEC cuts, an improving world economy, yet declining oil demand long-term.

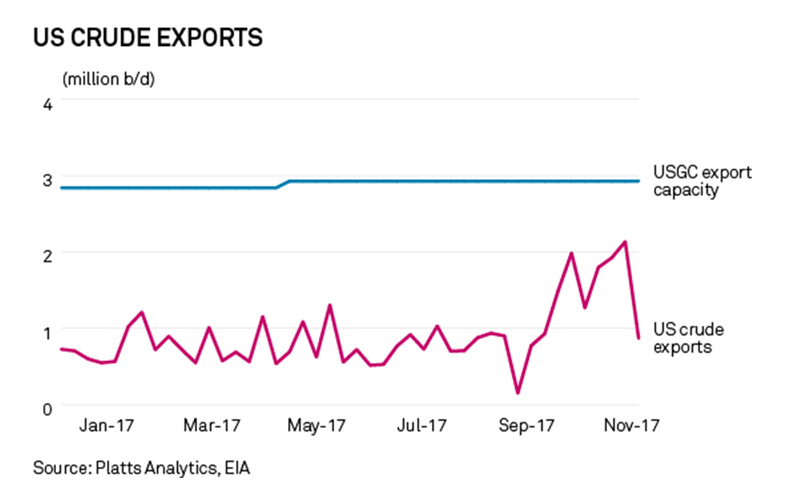

For US oil producers the picture is clear at least, it’s a bright future ahead. US crude prices are at multiyear highs despite North American oil production that shows little sign of slowing down.

That is especially true in the US Gulf Coast, where demand for every barrel, heavy or light, sour or sweet, continues to be robust.

As an example, take prices for the regional medium sour blend LOOP Sour, which reflects the value of crudes most-consumed by the massive US Gulf Coast refining sector. LOOP Sour was trading at the beginning of Q4 at a roughly $2/b premium to the underlying market of cash West Texas Intermediate at Cushing, Oklahoma. Six months earlier, it was closer to cash WTI minus $2/b.

To continue article from the Barrel Blog, please click here.