Source: S&P Global Platts

US Onshore Day Rates Expected to Continue to Rise

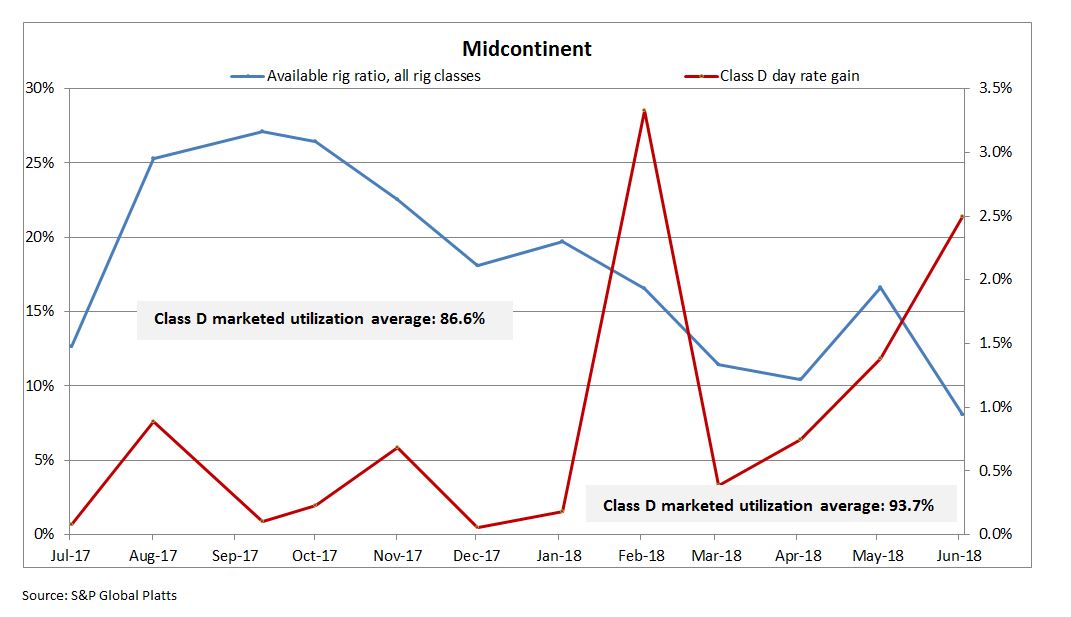

The US onshore drilling industry seems to be approaching an inflection point in rig demand metrics that suggest day rates will continue to rise but at a higher threshold than in the second half of last year, when the day rate recovery was just gaining traction. In support of that view, according to Platts RADAR, is a recent surge in day rates for the most prized rig model in the two hottest markets in the US: the Midcontinent and the Permian. In both instances, the two regions each posted their biggest 2-month gain for Class D rigs in more than a year—the Midcontinent by a cumulative net increase of 3.9% and the Permian by a net cume rise of 3.4%. For the Midcontinent, the May-June hike was almost double the net cume day rate improvement for all of 2H 2017. In the Permian, the average sequential increase for the latest 2 months was roughly triple that of the average monthly increase over the preceding year.

What Platts RADAR finds especially notable here is twofold: 1) These are typically the two most competitive markets in the US because of the wide range of plays they host, and 2) The two regions have their overall rig demand metrics dragged down because they host more than half of US active sub-1,000 hp rigs. The latter point is important because these smaller, less-utilized rigs’ presence in the portfolio of market-wide metrics for rig demand skew the overall numbers. But putting together the fundamental rig demand metrics and day rate gains in these two hottest markets reminds us to look at the context for the most desired rigs in the hottest markets. Relying on the broader utilization and rig count metrics distracts us from the view that a broad newbuild program, for at least the super-spec rigs, could be closer than we realize.

FREE TRIAL OFFER

Receive a free one month trial of RADAR (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.