Source: Barrel Blog | December 20, 2017 | John Kingston, Director of Global Market Insights

A few weeks ago in London, at a pre-conference dinner before the Platts Digital Commodities Summit, the conversation naturally turned to bitcoin and other cryptocurrencies, and the rejection – and disdain – that many supporters of the entire crypto movement have for what are known as “fiat currencies.” Most people know fiat currencies as everything from afghanis (Afghanistan) to zlotys (Poland), with dollars, yen and euros in-between.

Crypto currencies have been likened to gold: not controlled by a central government, a supply that rises only incrementally (and in the case of bitcoin, will eventually be capped), and therefore not inflationary. One of the conversation’s participants in the restaurant’s cigar bar, a backer of bitcoin, said to another person: “Look at that suit you’re wearing. I’ll bet you 200 years ago, if you had bought the equivalent suit and paid for it in gold, it would cost you the same amount in gold then as it would today.” Gold isn’t volatile against the dollar, he said. The dollar is volatile against gold.

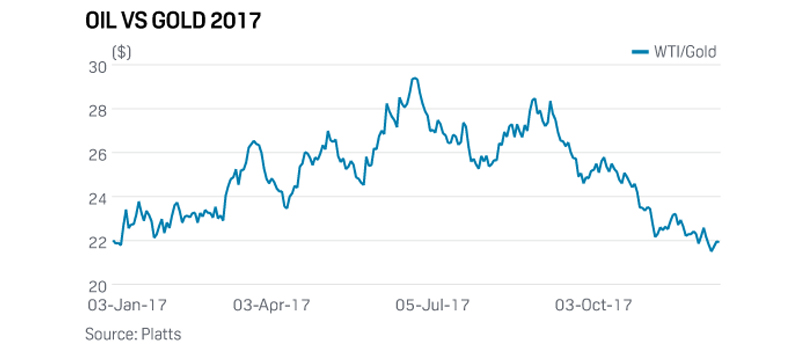

S&P Global Platts has a price database of many things. It doesn’t have one of men’s suits, so it is tough to confirm the relationship. But every year at this time, we take a look at the price of oil through the prism of how much gold it would take to buy a barrel of oil.

Last year, we suggested that changes in the fundamentals of oil may have moved the normal relationship between the two commodities to a higher number. Our 34-year comparison of gold and oil — which commences in 1984 with WTI, as that data goes back further than that of Brent — averaged 16.65 through 2016. That is somewhat higher than the conventional wisdom that the ratio of oil to gold—the number of barrels of oil needed to buy an ounce of gold—has a “norm” of 15. From the start of 2003, the average is much closer to 15, standing at 15.41.

To complete article, please follow this link to the Barrel Blog.