Source: Platts RADAR | December 7, 2017

Source: Platts RADAR | December 7, 2017

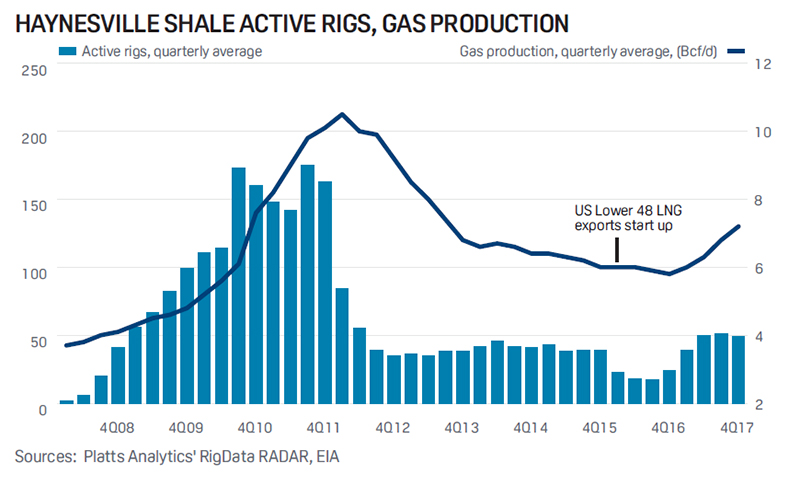

The Haynesville Shale, the one-time darling of the US unconventional oil and gas drilling business, fell out of favor during 2012–2014 when the industry activity otherwise was booming.

Spurned by operators due to sluggish natural gas prices, a persistent glut amid middling demand, and a coterie of former admirers now chasing after oilier plays with WTI teasing $100/bbl, the Haynesville Shale active rig count fell by more than -70% during 2012–2013 even as the overall US active rig count was still building to a peak.

When the overall US active rig count collapsed in 2015–2016, the Haynesville tally still had further to go in its decline—dipping into the teens during mid-2016. But the Haynesville is looking better than it has in recent years. The “makeover” is the increased demand for dry gas from a combination of surging LNG exports and a burgeoning new megacomplex of petrochemical facilities along the Gulf Coast.

The petrochemical capacity buildup is just beginning to ramp up, as $150-$200 billion in projected capital investment could cover as many as 200 projects over the next 5 years.

To complete article from Platts RADAR, please contact our team at 817-371-0083.