Enverus Quick Price, November 4, 2019

US crude oil inventories increased 5.7 MMbbl the week that ended Oct. 25, according to last week’s report from the Energy Information Administration. Gasoline inventories decreased 3.0 MMbbl while distillate inventories decreased 1.0 MMbbl. Total petroleum inventories were down 2.2 MMbbl. US oil production was flat on the week, while imports rose 0.84 MMbbl/d to 6.7 MMbbl/d.

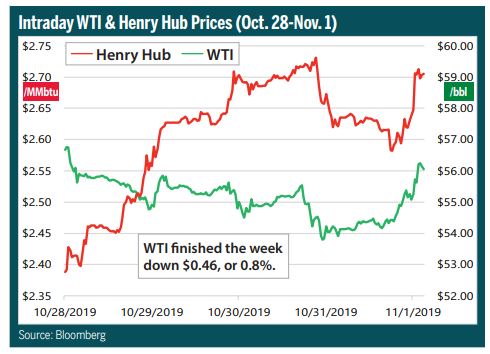

WTI prices spent most of the week giving back gains made the previous week in anticipation of production cuts that could come out of the upcoming OPEC+ meeting in December and could spur China to increase oil import quotas. There are conflicting reports on whether Russia will be interested in participating in additional cuts and lingering concerns regarding global economic growth seemed to fuel selling until Friday. Good economic news from the US Labor Department, surprisingly positive manufacturing data from China, and optimism about a potential US-China trade deal generated an overall bullish economic outlook on Friday that lifted both US equities and the crude market. By the end of the day, WTI had regained most of the week’s losses to settle just $0.46 below its price from a week earlier.

Regardless of the spot price action during the week, the spot contract is holding a significant premium to the 2020 strip. While the January contract continues to maintain a slight premium to December, the rest of the year is showing discounts as the trade remains concerned about global economic demand and the potential for a supply glut during 2020.

(continued below)

TO SEE A SAMPLE OF ENVERUS QUICK PRICE REPORT

CALL 713-650-1212

The Commodity Futures Trading Commission report released Friday, showing positions as of Oct. 29, demonstrated little change in the expectations of price direction by the speculative sector. The Managed Money long sector reduced positions by 2,706 contracts, while the Managed Money short sector reduced positions by 14,307 contracts. The current speculative sector is noncommittal to the crude oil trade.

Market internals last week also confirmed a non-directional neutral bias with prices closing just $0.46 below the previous week’s high close on higher volume and slightly lower open interest, according to preliminary reporting from the CME.

Prices continued to stay within the recent mini-range of $53-$57 waiting for the development of a trend for near-term prices. Bullish news will take prices upward toward the commonly traded 200-day moving average ($57.15 today), and a breakout above that level on a daily closing basis will send prices toward the highs from September, between $58.49 and $59.39. Bearish input from the declining rig count and concerns about the global economy could bring another test at the low end of the range at $53, which will likely find buyers.