Source: Platts RigData RADAR | May 25, 2017

Source: Platts RigData RADAR | May 25, 2017

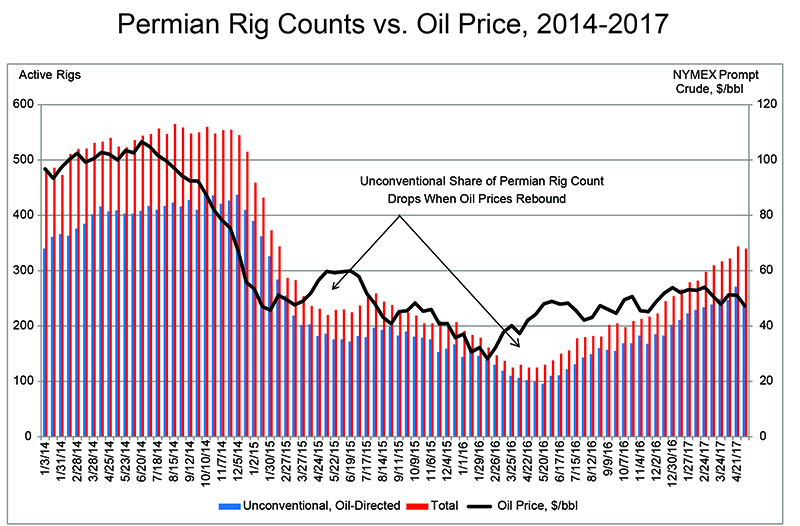

There is an interesting conundrum in Permian drilling and production trends that Platts RigData’s RADAR dubs the Permian Paradox: In the Permian Basin, when oil prices rebound, the share of unconventionals in the rig count declines and oil production growth lags.

Conversely, when oil prices soften, the unconventionals’ market share in the basin climbs again, followed by a renewed surge in oil production.For example, when oil prices were >$90/bbl in 2014 through Q3, the share of unconventional rigs in the total Permian rig count averaged 75%.

As oil prices plunged in Q4 of that year, unconventionals saw their share jump to 79% and then peak at 84% in 1Q 2015, by which time oil prices had fallen to half their 2014 peak. Oil prices generally have been buoyed since 2Q 2016, and unconventional rig count market shares have plummeted to their lowest level in the Permian Basin since 1Q 2014. But even with the periodic slowdowns in production growth when unconventional market shares lagged,

Permian oil production has grown by a net 900,000 b/d since 1Q 2014. The upshot of all this is that it appears that the overall trend in the Permian Basin is shifting toward more operators drilling more wells—and more prolific wells at that—and completing more of them instead of “banking” them as DUCs. That means even more oil supply in a market that’s already tenuously balanced, irrespective of extended cuts by OPEC and its allies.

Call 800-371-0083 to subscribe to Platts RigData’s RADAR, the leading statistical monitor of overall land rig market activity and drilling trends by region, play, operator, driller, and many other proprietary metrics.