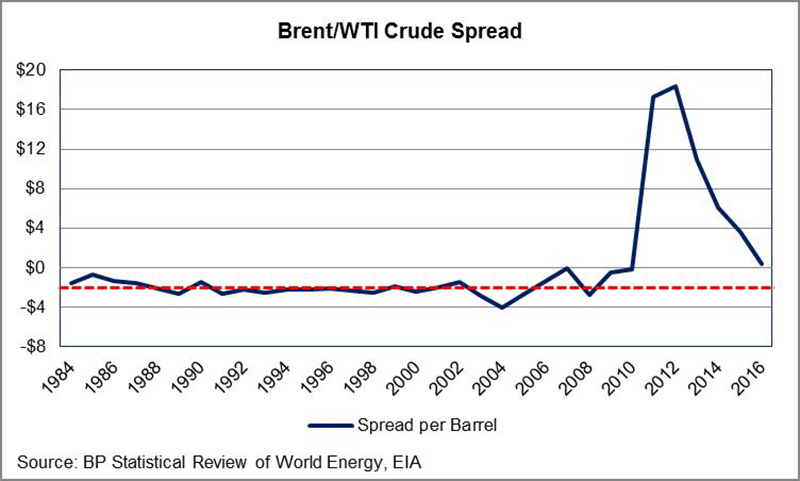

In the 25 years leading up to 2011, Brent and WTI crude prices tracked closely, with WTI crude barrels trading at an average $2 premium. From 2011 to 2013 there emerged a significant price disparity, wherein Brent prices received a hefty premium of +$15 per barrel on average. Subsequently, the downturn of 2014 ushered in price reactions for both Brent and WTI that resulted in the two grades again trading at parity with one another during 2016.

Will the conditions that caused the spreads to widen resurface if WTI stabilizes at $45–$65/bbl? When Brent traded at a significant premium, a key discounting factor of WTI was the build in oversupply at Cushing, Oklahoma. Essentially, domestic production had rapidly ramped up due to developing production quickly coming online from both the Eagle Ford and Bakken shales. Furthermore, crude oil transportation infrastructure was not aligned to allow satisfactory access to all this new crude.

Additional pipeline capacity and terminals helped alleviate the conditions that originally caused the Brent/WTI spread to widen. At the same time, margins for US refineries improved because they were able to substitute low-cost domestic crude for similar but higher-cost imported crudes—and refiners were able to expand their crude runs to maximize their profits during this time. Furthermore, the US dropped its ban on exporting crude, opening up new markets for US crude. All of these changes were catalysts that allowed the unusually wide spread between Brent and WTI prices to narrow.

Platts RigData expects that a mean reversion towards historical levels (i.e., WTI trading at a slight premium to Brent) is more likely than not in the current price environment. Low prices favor cheap domestic production because Brent has to price at levels low enough to offset transportation costs. With that in mind, it’s likely that the downward trend of the spread in the last few years will meander towards the historical average of -$2/bbl (the dashed red line in the nearby chart).