Source: Enverus Drillinginfo RigData RADAR, November 14 2019

Trey Cowan, Senior Analyst, Enverus Drillinginfo

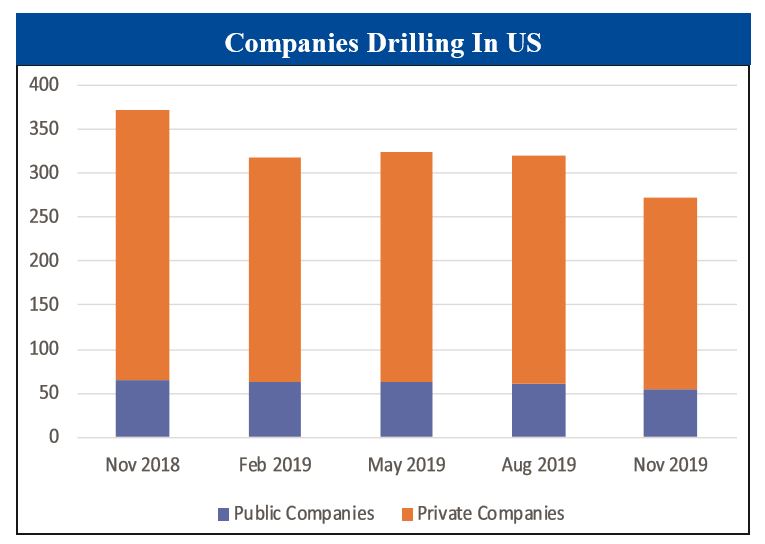

Nearly two-thirds of the rig count drop over the past 12 months was due to privately held companies idling their drilling rigs. During this period, a net 29% of the private operators, who were drilling at the beginning of this period, have since suspended all their U.S. drilling operations.

When we look at the corporate structure of E&P firms drilling wells across the Lower 48, we note that the dominant category in this mix is privately held companies. And as alluded in our title, the math works out perfectly with this rule of thumb; in that the percentage of private companies actively drilling is 80% of the overall total (i.e. 218 private companies out of 272 total active E&P companies).

However, these private companies control a smaller proportion of the active drilling fleet, with a little less than half to the current rig count falling under their purview (348 out of the 767 rigs). Over time it has been a small number of companies (around 60 firms during the past year) that have controlled and deployed about 60% of the US drilling fleet.

FREE TRIAL OFFER

Receive a free one month trial of RigData Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService@RigData.com

Mention code 7HHONRPT

REE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Dissecting the drop in the rigs over the past year a little further led us to the observation that a significant portion of the decline in the overall count was due to private companies entirely exiting the field. A year ago, there were 307 private companies drilling land wells in the US. Today, there are only 218 private companies drilling wells.

Dissecting the drop in the rigs over the past year a little further led us to the observation that a significant portion of the decline in the overall count was due to private companies entirely exiting the field. A year ago, there were 307 private companies drilling land wells in the US. Today, there are only 218 private companies drilling wells.

This change over the past year, that resulted in a net drop of 89 private companies no longer actively drilling wells, corresponds with 149 rigs that went idle in the past year. In summary, 75% of the drop in private operator rigs over the past year (i.e. 149 idle rigs out of a total 196 idle private rigs) was due to the E&P companies that suspended their drilling operations altogether.

Private companies tend to have smaller drilling campaigns than publicly traded companies. We note that the average number of rigs used by private companies has held steady at slightly less than 2 rigs per company. Conversely, publicly traded companies have had an average usage of slightly more than 8 rigs per company over the past year. And on average the total ratio of rigs per company drilling has held steady over the past year at nearly 3 rigs per company.

The interesting thing to note about this ratio analysis is observed when we apply the ratio to the number of idle operators versus the number of idle rigs. What we found was that in each of the three categories (i.e. private, public and total) the ratios for proportional drops in rigs per companies were greater. This observation helps explain the phenomenon that during this and previous cycles the steepness of declines have a occurred at a much more rapid pace than ascensions.