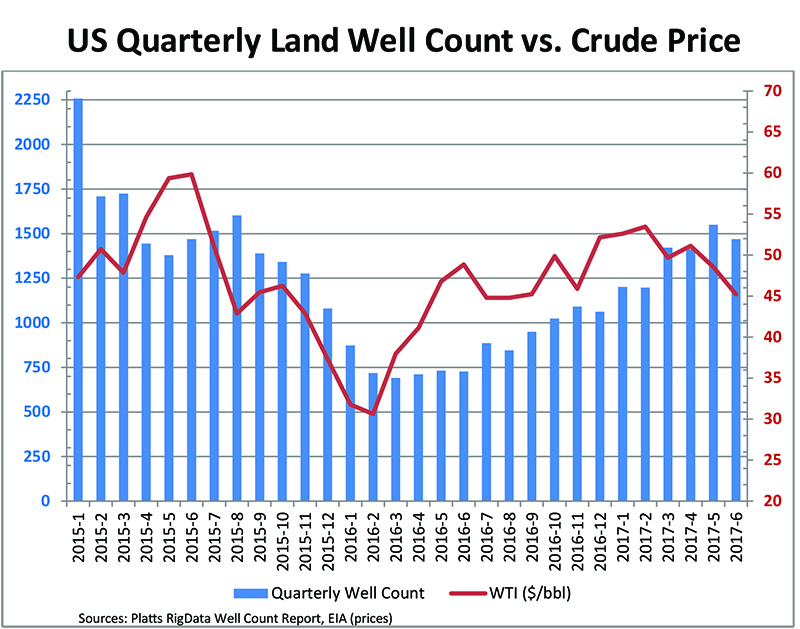

The positive trend in US land drilling activity that began in 4Q 2016 has continued through 2H 2017. However, market uncertainty began revealing itself as oversupply worries continued and commodity prices declined during the final month of Q2.

The total number of wells drilled during 2Q 2017 increased by +612, or +16%, vs. Q1 to a total of 4,433 new well starts. While the number of wells drilled increased quarter-over-quarter in Q2, Platts RigData cited a decline in the quarterly rate of growth vs. Q4 and Q1, +18% and +20%, respectively, in its latest quarterly Well Count Report.

After Henry Hub futures prices consistently experienced gains in each of the 6 prior quarters, natural gas prices started declining in June, driving the slowdown in gas well count by -4% QTQ.

On the other hand, the number of oil-focused new well starts continued to grow in Q2 even as crude prices experienced losses totaling -7% QTQ. Even so, operators drilled an additional +648, or +22%, more oil wells than in Q1.

Observing changes in the quarterly well count share by operator capitalization class, private operators have been gaining well count share over the last 2½ years, while the Large-Cap operators’ well count share has fallen in that time. In 1Q 2015, Large Cap and private operator classes held 38% of all new well starts, and in the most recent quarter, that shifted to 50% of new well starts for privates and 30% for Large Caps.

Call 1-800-627-9785 to subscribe to Platts RigData’s free quarterly Well Count Report.