Source: S&P Global Platts Analytics

Source: S&P Global Platts Analytics

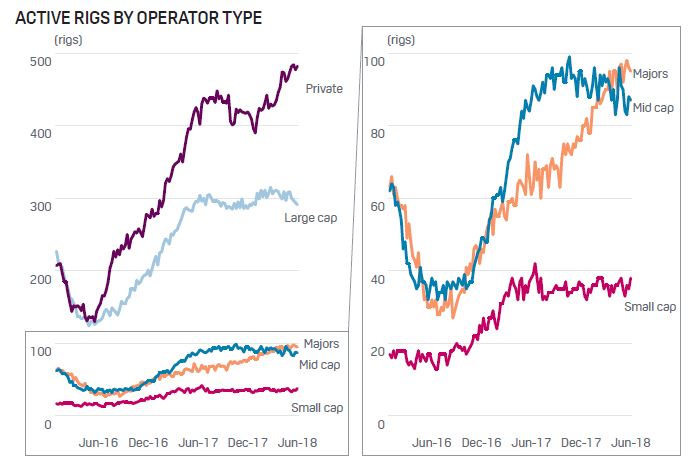

Rig Count Growth Following Barbell Pattern

Trey Cowan, Senior Industry Analyst, S&P Global Platts

Privately held companies are responsible

for most of the growth in the US rig count during 2018.

Represented by the purple line in

the left-hand graph (which segments

the US land rig count by operator type);

270 private companies are using nearly 500 rigs to drill their wells. Relative to

activity levels at the end of 2017, the

privately held group’s rig count is up 91 rigs and accounts for 82% of the year-to-date

growth in the overall rig count.

The rig counts of publicly traded

producers (segmented by size) have

experienced a flatter trajectory year-to-date, with one exception. Represented by the red

line in the graphs, the Majors (integrated

oil companies whose membership includes

Chevron, ExxonMobil, ConocoPhillips,

Royal Dutch Shell, and BP) have increased

their rig activity by 22% since the

beginning of the year.

ExxonMobil an outlier

But digging in a little further we

see that just one company (among the

Majors), ExxonMobil, was responsible

for all of the segment’s growth year-todate.

In fact, ExxonMobil has nearly

doubled its rig activity from the beginning

of the year until now—and with this rig

growth has catapulted itself back into the

top spot in the rankings, having the most

land rigs actively deployed in the US with

a fleet of 43 rigs.

The Permian, SCOOP/STACK, and

Haynesville were all hosts to additional

rig activity where Exxon Mobil’s drilling

fleet grew this year.

So the rig growth that we have seen

thus far this year has followed a barbell

pattern in that the largest company drilling

in the US and the typically small private

companies are leading the charge.

Output grows even with steady rig count

Meanwhile, the rank-and-file

operators in the middle have shown little willingness to increase their drilling activity levels.

FREE TRIAL OFFER

Receive a free one month trial of RADAR (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

However, the lack of upward

change to rig counts by most publicly

traded operators this year is not an

indictment on production growth. The

ever increasing well intensity shown

by operators in the wells they have

drilled of late continues to add more incremental units once these wells are completed relative to their predecessors. Thus, all else being equal, production is expected to rise even if drilling holds in

a steady state here in the US.

The take-away for the back half of

2018 is that we would expect stability (in

terms of drilling patterns) from much of

the publicly traded operators at today’s

prices or even a slight pullback in oil and

natural gas futures.

But private operators have tended to

exhibit more price sensitivity. Thus, a

slight slump in commodity prices could

adversely impact this group’s plans (that currently directs about half the rig count activity) over the remainder of the year.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.