Source: Drillinginfo RigData RADAR, September 12, 2019

Trey Cowan, Senior Analyst, Enverus Drillinginfo

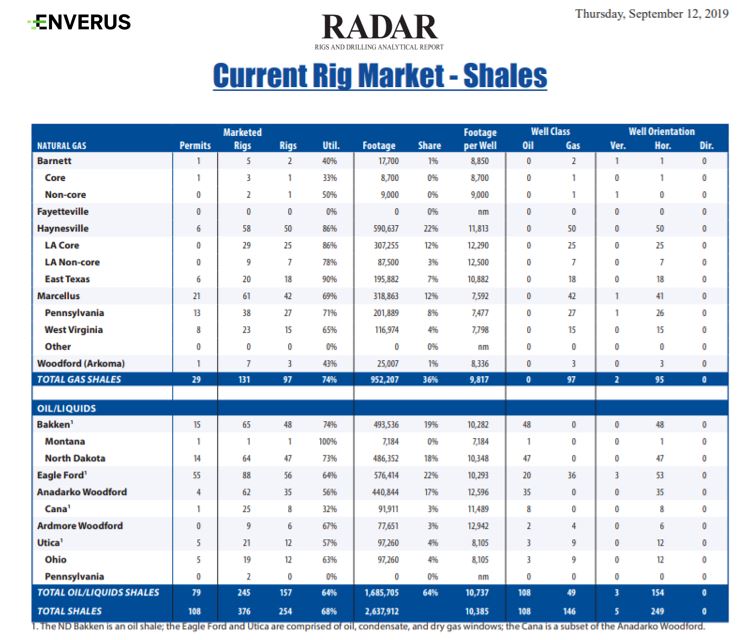

Weekly Market Pulse

The active US land rig count fell by 25 rigs versus the prior week to an overall total of 836 rigs actively drilling. In terms of targeted formations, the oil rig count dropped 30 rigs versus the prior week and now totals 597 active rigs. Conversely, gas rigs totaled 239 actively drilling, up 5 rigs versus the prior week. Permitting activity grew over the past week, up 110 approvals to a total of 885 permits approved in the past seven days.

Storage and Inventory Levels

The EIA’s Weekly Natural Gas Storage Report for the week ended September 6, 2019 experienced an injection of +78 Bcf relative to the prior week, with gas storage now residing at 3,019 Bcf. At present storage inventories are tracking 77 Bcf below the five-year average of 3,096 Bcf. The EIA’s Weekly Petroleum Status Report showed a 6.9 million barrel decrease for commercial crude oil inventories over the week-ended September 6, 2019. The current U.S. crude oil inventory storage level of 416.1 million barrels (excluding the SPR) is tracking 2% below the fiveyear average for this time of the year.

Commodity Prices

The front-month contract for WTI crude oil settled at $55.75 per barrel on September 11, 2019, down $0.51 per barrel from a week ago. September Monthly Oil Report by OPEC included downwardly revised demand projection (-60,000 bpd) for 2020 of 1.08 million bpd. This along with recent IEA report highlighting the challenges to global growth are currently putting pressure on oil prices. The front-month contract for Henry Hub futures (i.e. natural gas) settled at $2.55 per mmBtu on Wednesday, up 11 cents over the past week. Firming natural gas prices are an expected outcome considering traders are start looking past the fall to the strength that accompanies winter weather.

FREE TRIAL OFFER

Receive a free one month trial of RigData Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService@RigData.com

Mention code 7HHONRPT

REE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT