Trey Cowan, Senior Industry Analysts, S&P Global Platts

Trey Cowan, Senior Industry Analysts, S&P Global Platts

Source: Rigs and Drilling Analytical Report (RADAR), September 20, 2018

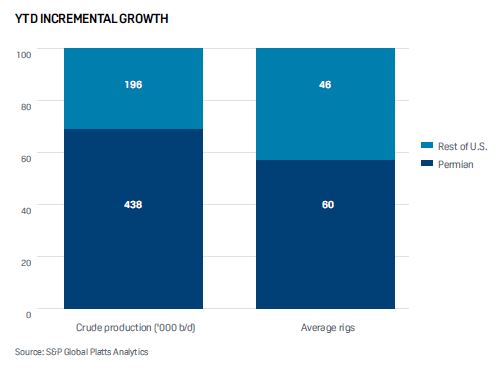

The domestic growth for both drilling and production has been dominated by producers focusing most of their attention on developing their Permian Basin assets this year. Specifically, crude & condensate production from New Mexico and Texas Permian tight oil wells accounted for 69% of the total U.S. production growth, the Permian rig count contributed approximately 57% of the growth in the overall domestic land rig count.

Unfortunately, all this growth has come with a cost. This incremental Permian production is now bumping up against the capacity constraints of getting this growing crude supply to market. As these concerns have intensified with this production growth, we have seen differentials (i.e. the variance between benchmark prices and those realized at the wellhead) to widen significantly.

FREE TRIAL OFFER

Receive a free one month trial of Platts Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Differentials for WTI Midland are pegging these barrels at over $16 per barrel discount to NYMEX benchmark crude prices.

Permian operators who lack firm transportation commitments out of the region or who lack hedges in place that offset these differentials would be logical choices to curtail both rig activity and production in the months ahead. We can see from recent reports is that permits, rigs, and production are in fact beginning to slow in the Permian. Further, we expect that future observations will identify whether producers shifted

their responses to other major plays to adjust to these dynamics in the Permian. At present we are expecting a slight shift of rigs to the Eagle Ford, southeast of the Permian, to reduce some of the slack that may develop in the months ahead.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT