Source: S&P Global Platts RADAR, February, 2019

S&P Global Platts, Oil Analytics, Andrew Cooper

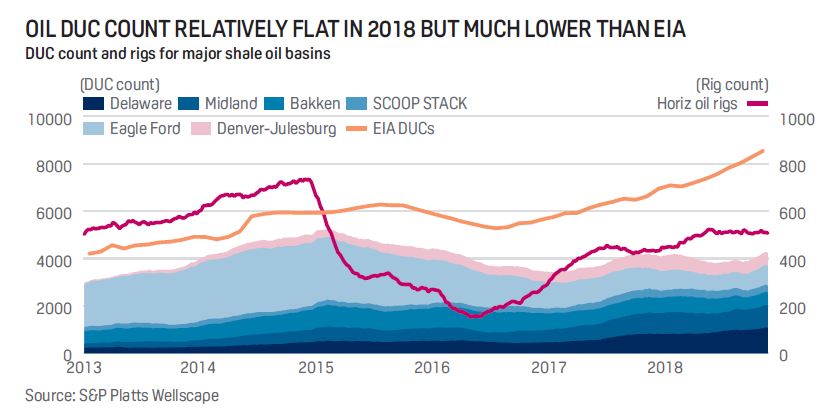

Platts Analytics has undertaken a major bottoms-up study of DUCs using propriety Platts Wellscape data. We have found that DUCs in the Permian and DUCs in the non-Permian shale plays exhibited very different behaviour in 2018.Permian DUCs increased 19% due to outside constraints such as pipeline takeaway capacity, widening commodity price differentials, and a shortage of experienced frack crews. The non-Permian plays experienced a 9% decrease in DUCs on a slowdown in drilling activity. In recent months, however, the overall DUC count has been ticking higher. In the Permian, takeaway capacity limitations continue to constrain completions, although we foresee a DUC drawdown when new takeaway capacity is installed in late 2019. Outside of the Permian, in most other basins, DUCs remain in decline and we expect this trend to continue in these other basins as operators maintain or decrease drilling activity in 2019.

Platts Wellscape is a full well lifecycle database that contains information from permitting to abandonment for nearly all onshore wells drilled in the U.S. Using this database of more than 500,000 wells, Platts Analytics has undertaken a bottoms-up count and classification of all drilled but uncompleted wells. We have come up with a new DUC methodology that classifies wells based on their age and likelihood of being completed in the future. Please see below for more details on our methodology, including a comparison with the EIA. We plan to update DUC counts for all the major oil plays on a periodic basis and share the results with our clients.

Platts Analytics counts a total of 4,200 DUCs for all major shale oil plays, which includes wells that have been drilled in the past 1-3 months but not yet completed (“Young DUCs”) and wells for which the completions have been explicitly deferred by the operator (“Adult DUCs”). These DUCs represent some

2.9 MMB/D of theoretical production, assuming an average 30 day well IP of 700 B/D and all wells being completed at once. The actual uplift will be much lower depending on when the wells are completed and

also the annual impact will be significantly lower since shale oil wells on average decline around 70% during the first year of production. For illustration purposes if the entire current inventory of 4,200 wells were completed during one year, it would result in additional production of around 900 MB/D

for the year.

FREE TRIAL OFFER

Receive a free one month trial of Platts Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

PLATTS DUC METHODOLOGY

We have classified wells based on their associated age and derived a ‘most-likely’ DUC count.

The Young DUC. Right after a well is drilled, it takes a certain period of time for a completions crew and the hydraulic fracturing material to become available. This natural cycle varies by basin, but on average takes around 1-3 months. Wells within this buffer period are grouped into the Young DUC category. Young DUCs are not quite DUCs, as they are typically completed in due/ normal time. Also, pad drilling versus individual well drilling influences the natural cycle.

The Adult DUC. After the natural cycle ends and the well is still not completed, the wellcompletion process is explicitly deferred by the operator due to a variety of reasons (e.g. pipeline constraints, lack of frack crews / material, or commodity price differentials in a region). Draw down of DUCs comes primarily from this category and the rate of depletion normally accelerates during periods of low oil prices (i.e. 2015-2016) or lower drilling activity.

The Retired DUC. In industry, many wells are drilled and sit in inventory for many years. There reaches a point where a well becomes too old to be completed due to integrity issues or because it is uneconomical. These Retired DUCs are part of the well inventory but are not included in the DUC count, as operators are very likely to never complete these wells. Wells in this category are normally greater than 4 years old.

The Platts Analytics DUC count is the sum of “Young DUCs” and “Adult DUCs”, which represents, in our view, the most likely count of wells to be completed.

Our new DUC count fits well with historical correlations between oil prices, rigs, and DUCs. When oil prices increase (as they did in 2014) so do rig counts and DUCs. When oil prices decrease (2015-2016) so do rigs and DUCs. In the past 7 months, rig growth has leveled off and therefore the rate of growth of DUCs has also decreased. On the other hand, the EIA shows rising DUC counts despite recent lower drilling activity.

The Permian chart illustrates our most likely DUC inventory (DUC Count: young DUCs + adult DUCs) and also the old drilled wells that are unlikely to ever be completed (Retired DUCs). Currently our most likely Permian inventory consists of ~ 2,000 DUCs with another 450 Retired DUCs that are likely to never be completed.

COMPARISONS TO EIA METHODOLOGY

The EIA counts all wells 20 days after drilling commences as a DUC. Our methodology uses the natural cycle by basin, usually 20 to 90 days after a well is drilled.

The EIA includes old wells in its DUC count. But in our analysis, statistics show that older wells (> 4 years old) are unlikely to ever be completed.

The EIA uses FracFocus as their main source of completion information. However, we have found that this data can have significant lag times in certain areas and can overestimate DUCs. As such, it continues to show a sharp increase in DUC counts despite a flattened rig count in the past 7 months.

This is an excerpt from S&P Global Platts RADAR, February 14, 2019 issue.

Call 800-371-0083 to request a sample copy.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT