Source: Rigs and Drilling Analytical Report (RADAR, August 30, 2018), S&P Global Platts Analytics

New Breed of Private Independents Likely to Surprise with Crude Production Upside

There’s been a sea change in how private operators are impacting the

upstream market in US oil drilling.The thrust is this: They are emulating

their larger brethren more so than ever before as this new breed of private

operator continues to expand its effect on the market.

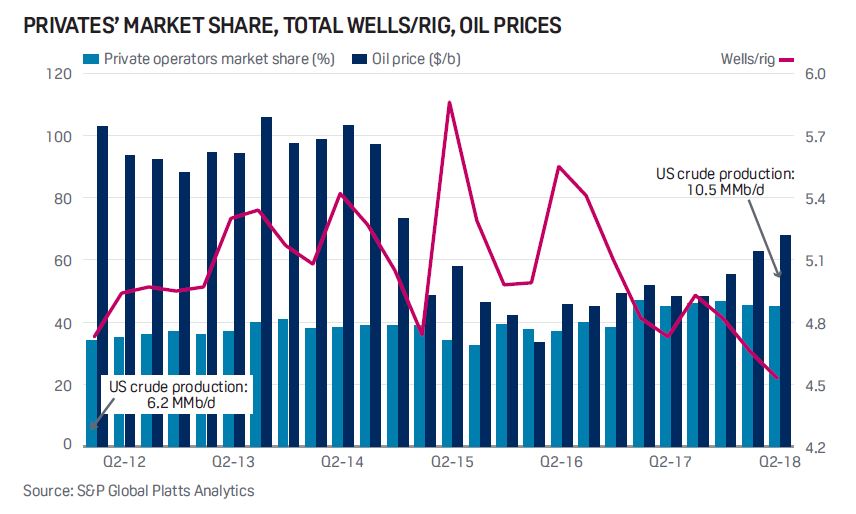

From 2011 through 2015, private operators represented an average

37% of the market according to how we’ve tracked operator company

classifications. During this period, their market share surpassed 40% only 15%

of the time.

Even in 2016, as the downturn worsened, their average market share

was 39% for the first half of that year. The tide turned in mid-2016, and since then

their market share has averaged 47%. In June of this year, this cohort topped 50%

of the market, the first time we’ve ever recorded this accomplishment. In June

2018, the number of privates topped 500, the first time that has happened

since January 2015, when the overall active rig count—on its way down since

October 2014—was still more than 1,500. The 500-rig threshold has been

the new floor for these small companies ever since.

FREE TRIAL OFFER

Receive a free one month trial of RADAR (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

In the not-so-distant past the arrival of such a large contingent of small private

companies would mean a proportionate increase in the number of vertical wells

and total wells and a commensurate increase in the production of crude oil

from the wells they’d complete—which means not a lot of incremental volume.

When horizontal wells started to take over the US onshore drilling world, oil

prices were much higher, and the private operators were typically the mom ‘n pop

outfits that frequently had long family traditions in the business, often keeping

watch over stripper wells whose oil production could be often measured

in single or low double digits. These wells collectively over time provided

a noteworthy tranche of foundational supply to the US energy demand, but

when these traditional private operators drilled new wells, typically it was in

response to a surge in commodity prices, and their activity was limited and often

short-lived. Even in the aggregate, they would scarcely move the needle on

production totals, usually overwhelmed by declines in the nation’s larger oil fields.

Once large-capitalization public independents jumped on the unconventional

bandwagon, they quickly assumed the leadership role in active rig count. That

pushed horizontal rigs to the foreground with a little less than two-thirds of active

rigs, and by 2012, vertical rigs were only about one-fourth of the rig count. Even

then, private operators still accounted for a bit more than one-third of the rig count.

By this time, US crude oil production had recovered from its decades-long decline,

having dropped below 5 million b/d in 2008 and rebounded to 6.2 million b/d by

1Q 2012.

By 2012, the large caps and the privates were pretty much neck-and-neck

in leading market share in terms of rig count. The privates were also reflected in

the dynamics surrounding the size of rig fleets. Typically, they represented the ≤3

rigs category, the smallest one.

In 2012, with total active operators numbering 454, even though the privates

challenged the large caps in terms of overall rig count market share, the ≤3

rigs fleet represented only about 27% of the total rig count. That means that the

market was robust enough that a large number of privates moved up to the next

higher fleet category.

For the complete article contact CustomerService.RigData@spglobal.com

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.