Source: Enverus Drillinginfo RigData RADAR, September 19, 2019

Bob Williams, Director of Content, Enverus Drillinginfo

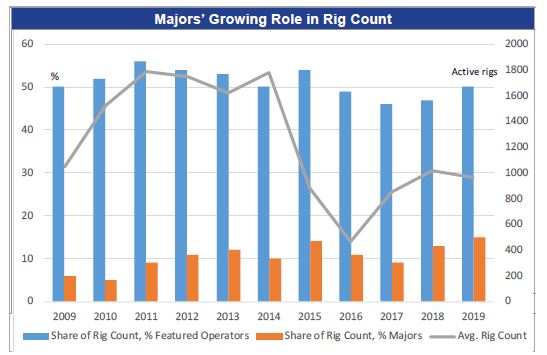

Major oil and gas companies’ share of the active rig count has more than doubled in the past decade.

In 2009—a keen inflection point for the industry as a brief but severe downturn—majors accounted for just 6% of the total active rig count average for the year.

That number stayed in single digits until 2012—another inflection point, when the burgeoning unconventional drilling growth catalyzed a newbuild rig boom.

From 2012 to 2019, save for a brief dip to 9% in 2017, the majors’ share of the rig count was in double digits. It peaked this year at 15%.

The majors’ rig counts were taken from the Featured Operators table on p. 15 of this report (September 19, 2019, RADAR). That table represents about half of the active rig count through the past decade.

For years, this table had been headed by the large public independent Chesapeake Energy going back to at least 2007. In 1Q 2009 for example, Chesapeake was well out in front of all other operators; the highest ranking for a major was No. 5, and several majors had no more than single-digit tallies—ExxonMobil among them.

Fast-forward to today, and ExxonMobil handily tops the list— thanks to its acquisition of XTO for $31 billion.in 2009 (XTO vied with Chesapeake for the No. 1 spot in prior years). Chesapeake didn’t relinquish its role as the top driller to ExxonMobil until January 2015, and the world’s biggest oil company (by market cap) has been the US onshore rig count leader ever since.

There are mixed signals today as to whether there will be a continuing trend toward consolidation in the industry. Majors in particular have been having trouble replacing reserves, and the best way to do it quickly these days is to acquire unconventional oil and gas assets in the US.

But thus far in 2018–2019, M&A activity has languished despite a single spectacular deal. Several majors are said to be reviewing their portfolios, but megadeals have been few and far between.

FREE TRIAL OFFER

Receive a free one month trial of RigData Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService@RigData.com

Mention code 7HHONRPT

REE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Tight capital forcing more M&A?

Another inflection point was Occidental Petroleum’s $57 billion acquisition of Anadarko Petroleum. It was the fourth largest industry deal ever, according to Drillinginfo analyst M&A Andrew Dittmar

Drillinginfo released its 2Q 2019 summary of M&A activity in July.

“Occidental dominated headlines this quarter with assertive maneuvering to beat out much larger rival Chevron and secure a deal with Anadarko,” said Dittmar in July. “While Anadarko’s assets span the globe, the deal is largely a play on US shale —particularly in the juggernaut Permian, which continues to power US production growth.”

One of the biggest hurdles to acquisitions by public companies is an almost complete lack of Wall Street financial support. Halfway through 2019, there has been little-to-no growth capital provided via follow-on equity raises to US public operators.

Public E&Ps are tightly focused on efficiently drilling existing inventory, which they appear to be doing effectively as US production continues to grow, despite Drillinginfo analysts observing an expected 20 percent average capex cut for 50+ E&Ps in 2019.

“Wall Street, consistent with the message for E&Ps to live within cash flow, has cut off new investment dollars from public markets,” said Dittmar. “Smaller E&Ps, many of which were focused on growth and counting on continued funding, have been particularly impacted. Some of these smaller companies could evaluate whether they would be better off private.”

Private capital is still being deployed, but with a different model from past years.

“Private money is finding targeted opportunities,” said John Spears, Director of Market Research at Drillinginfo, said in July “The investment timeline may have lengthened from past years, but these companies still see opportunity to generate cash flow.”

What hasn’t happened so far in 2Q 2019 was a big push toward public company consolidation in the wake of the Oxy/Anadarko deal. Commentary from market participants, including management at the majors, indicates that the wide expectations in price between buyers and sellers make any deals challenging.

And just like ExxonMobil/TXO and Oxy/Anadarko deals proved to be anomalous, the widely expected market consolidation has failed to materialize.

And as it turns out, the growing market share of the rig count held by the majors can be laid at the feet of ExxonMobil, just growing organically.