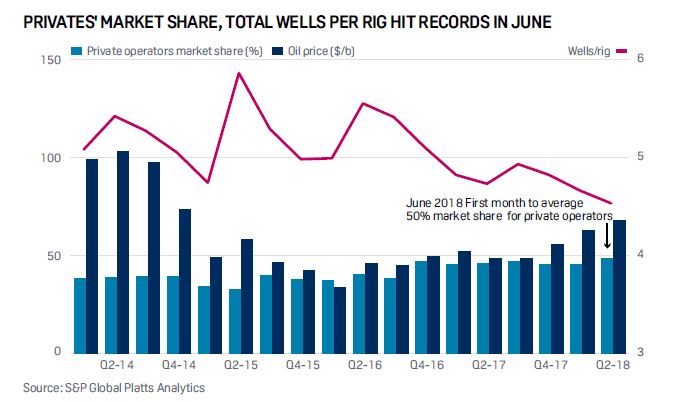

Source: Rigs and Drilling Analytical Report (RADAR, July 12, 2018), S&P Global Platts Analytics

June Records for Private Companies' Market Shares, New Wells Drilled Per Rig Show Increasing Uniformity of Drilling

As if to underscore the upending of traditional behavior by the

evolving

private oil and gas sector, the month of June

ushered in a pair of records: the

highest monthly market share on record for

private companies and the lowest

number of new land wells drilled per rig by

all companies.

Traditionally—at least since we started

tracking such metrics—private

operators held their share of the market to

less than 40% of all active rigs. This was

irrespective of the rig count total and/or oil

and gas commodity prices. From 2011 to mid-2016,

the privates’ market share held steady at an

average of 38%, ranging from 30% to 43%. Out of 124 reports on this metric, the privates’

market share had breached 40% only 24

times.

Since June 2016, the 53 market share reports show the privates have averaged a market share of 46%, topping 44% every single time. And it averaged more than 50% for the entire month of June, another first.

Typically, privates have built their market

share gradually through the

year, peaking in Q3, depending on the direction of commodity prices. Their

rig counts and well counts were usually smaller in the first quarter of year as

they secured financing for drilling programs,

then they would taper off

in Q4 or late Q3 as they spent down their

drilling programs for the year to

minimize the tax bite.

FREE TRIAL OFFER

Receive a free one month trial of RADAR (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Because of this behavior, the number of wells

per rig would move up in

accordance with a surging market for private operators. The nearby

chart

shows the quarters from 2014 inclusive through

2Q 2018, reflecting the boomand-

bust iterations of the worst downturn for the oil and gas industry. Up until

that

point, oil prices were at lofty levels well above where they are now, and

natural

gas prices were at record highs. A great deal of stability had permeated

the

market on drilling for both resources, and the privates’ drilling market

share

had moved up in steady increments during the post-2009–2010 bust.

At the same time, corresponding with that development, the number of

new wells drilled per rig would peak with the privates’ market

share—all

else being equal on commodity prices. That’s because the privates were

focused

on conventional reservoirs with vertical wells. Because vertical wells

usually are

drilled much faster, the nimble smaller, private companies could drill

more

wells per rig than the larger, usually public companies did. Even if you

had

3 rigs or fewer—the rig fleet category long dominated by small

privates—you

could drill wells more quickly and have a greater number of wells per rig.

Thus

the number of wells per rig would wax and wane in synch with the

privates.

And that gap only grew as larger companies focused more on

increasingly complex horizontal wells. It was especially so as larger

operators

high-graded their drilling locations and executed ever more complex

horizontal

wells in pursuit of return instead of

growth.

No more. Our latest quarterly well counts report will be published Friday

the 13th of July, and the evidence is clear: For the first time we see private

operators’ market share has reached unprecedented high levels, and yet the

number of rigs per well have plummeted to unprecedented low levels.

That can only mean that the cohort of private operators has become

increasingly tilted to companies focused on horizontal wells. And at last

report,

horizontal wells now accounted for about 88% of the market. As long as

that

metric holds—and we see no reason why it shouldn’t and even get

bigger—the

number of wells drilled per rig will slip.Because of the expanding ubiquity

of

horizontal wells, even as this ostensibly traditional marker for drilling

efficiency

declines, the production impact will become commensurately greater.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.