Source: Enverus Drillinginfo, RADAR, October 17, 2019

Trey Cowan, Senior Analyst, Enverus Drillinginfo

As we head into earnings season we expect to hear commentary from oilfield service companies and their E&P clients about the industry’s outlook. Given the current price environment for both oil and natural gas, there is “little doubt” by most, including us, that the prognosis may sound a little gloomy this time around.

The “little doubt” rests squarely with IMO 2020 watchers. So far, IMO 2020 has not materialized as the savior and cure for weakening global demand and low oil prices that we were told it could be. But like Y2K adherents from 20 years ago, there remains a staunch group of pundits still anchored to their predictions that, in this case, the bunker fuel spec change will ripple through the globe in a fashion that disrupts the applecart and pulls all energy prices higher in its wake. From their perspective, we just have to be patient and wait until January 1 to see the ramifications. While we still hope they are right, we are not holding our breath.

Permitting approval levels are starting to proffer an entirely opposite narrative for what next year holds. Weekly figures have fallen to where newly issued amounts approved are not keeping pace with existing rig counts. If we are to assume that submitted permits to drill by operators tend to track with their plans for upcoming activity over the near-term, then the current anemic pace of approvals suggests the industry is gearing down for less rig activity than is currently at hand.

(continued below)

FREE TRIAL OFFER - 4 FREE ISSUES

Receive a free one month trial of RigData Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService@RigData.com

Mention code 7HHONRPT

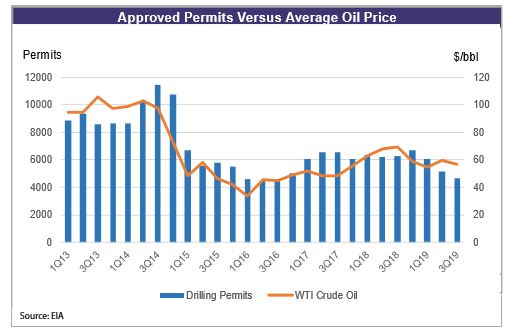

The introductory graph illustrates on a quarterly basis the relationship between oil prices and operators’ future plans for upstream activities (i.e. permitting approvals). We note that several human elements are involved in the drilling permit approval process that tend to mute the reliability of monitoring week-to-week changes. However, using an aggregated approach observing the data over months or quarters squelches out most of the noise. Here we see a parallel story between average quarterly oil prices and the total number of permits approved each quarter.

We draw your attention to the absolute number of drilling permits issued in 3Q19. Notice how we have not seen levels this low for quarterly permits since 2016. At that time, oil prices were about $11 per barrel cheaper than they are today. Extrapolating a mean reversion, assuming permits are a signal for future rig activity, points to several hundred more rigs going idle over the next year. We caution anyone from putting too much credence in technical indicators and a severe prediction like this. Because while we are observing a cyclical industry, there are many nuances and variables that tend to make each cycle unique.

Our conclusion would be that permitting trends are showing some weakness that could spell a continued drop in the rig count over the months ahead. However, the trend could easily be disrupted by some price improvement in both oil and gas. So, at the end of the day what we see is price remains the key driver and permits at the moment are down and dropping in tandem with a futures market that remains backwardated. Collectively, all these factors suggest that now does not appear to be the time to get optimistic about outlook for our industry.

REE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT