Source: S&P Global Platts RADAR, July 18, 2019

Trey Cowan, Senior Analyst, S&P Global Platts

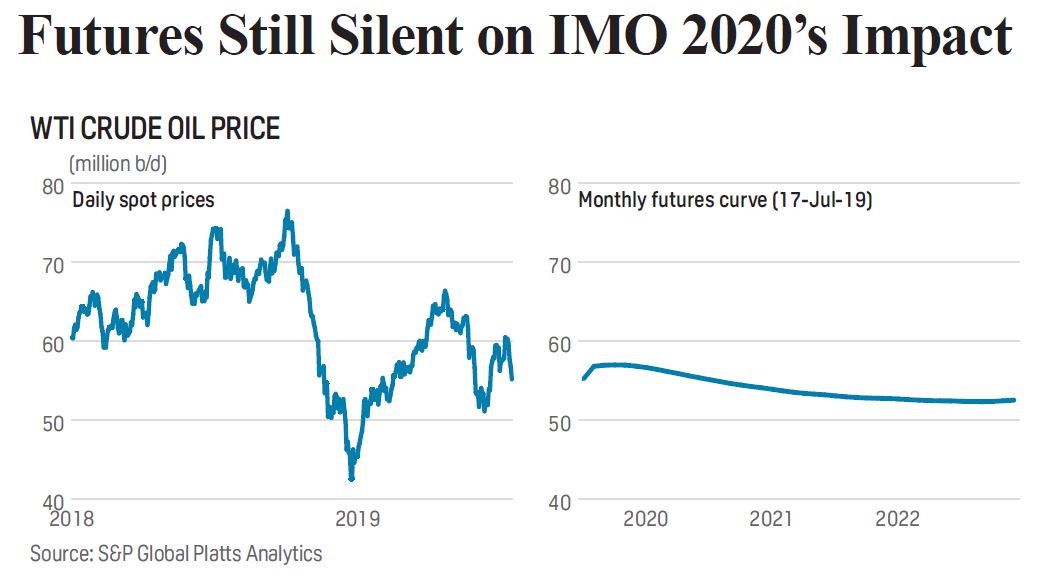

NYMEX WTI Light Sweet Crude Oil Futures are slightly backwardated

over the next three years, indicating the market’s generally bearish

sentiment towards the energy complex. Platts Analytics is currently

taking a contrarian view relative to what the existing the futures curve

is predicting.

Directionally, Platts Analytics anticipates oil prices will

take a turn for the better over the remainder of 2019. Several factors

are tipping the scales towards a more bullish than bearish outlook for oil

prices over the remainder of 2019. A recent webinar for S&P Global Platts

Analytics clients led by Claudio Galimberti and Richard Joswick,

Head of Demand and Refining and Head of Oil Product Pricing

and Trade for S&P Global Platts, respectively, highlighted themes that

could either propel oil prices or push them lower in the months ahead. The

following outline summarizes their views which holistically expect both

domestic and global oil prices to improve beyond existing levels over

the remainder of 2019.

Bullish Catalysts

1. Strait of Hormuz – In recent weeks crude prices have surged

after reports of incidents in the Strait of Hormuz including the

June 20th downing of US Navy drone and multiple tanker attacks,

presumably all undertaken by Iranian Revolutionary Guard.

2. Sanctions – Disruptions cause by the sanctions to Iran and

Venezuela are taking some barrels off the market.

3. Saudi Arabian Production – Saudi Arabia has been particularly

respondent to price signals and has adjusted its production accordingly.

Saudi production in 2Q19 was 300,000 barrels per day less than

1Q19 at 9.7 million bpd, according to OPEC Secretariat.

4. OPEC+ Production Cuts Extended – At the beginning of

July OPEC announced that it and participating Non-OPEC members

(primarily Russia) would extend their production cut agreement by another

9 months to the end of March 2020.

5. Tightening Crude Stock Balances – Crude distillation units

(CDUs) or refineries reported record levels of outages during 1H19

relative to prior seasons. Now that these planned and unplanned refinery

outages are past, we should start to see higher runs with both improved

utilizations and margins, which implies a better demand profile for

crude on the near horizon.

6. IMO 2020 – The IMO spec change is expected to pull up global

demand in 2020 due to higher draws on distillates, volumetric gains and

additional fuel oil consumed by the power generation stack due to its

weakening price.

FREE TRIAL OFFER Receive a free one month trial of Platts Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Bearish Catalysts

1. Weakening Demand – EIA recently lowered its global oil

consumption growth projection by -.2 million barrels per day to 1.1 million

barrels per day in 2019. Platt’s Analytics estimate for 2019 global

incremental crude demand is 1.2 million barrels per day. Weather early

in the year was a disruptive factor early in the year for both Europe and

the US impacting demand.

2. Trade Tariffs – The ongoing trade negotiations between the US

and China has created some additional uncertainty that has caused business

planners to take a more cautious wait-and-see approach.

3. Supply Glut of NLGs and Light Tight Oil – The big story behind this

supply glut is the strong uptick in Permian production.

4. Chinese Gasoline Spec Change – automobile purchases have been

weaker of late in China due to Beijing’s decision to alter both

gasoline and diesel specifications.

5. Poor Investing Community Sentiment – Institutional investors

have been trimming their portfolio weights, moving from moderate

energy exposure to underexposure relative to other business sectors.

IMO 2020 is the thumb on scale at the moment that tips things

towards higher crude demand and is also behind Platts Analytics

bullish outlook for some products. Essentially, IMO 2020 calls for the

switch from 3.5% to -.5% Sulphur content in bunker fuel (i.e. from high

Sulphur to low Sulphur fuel oil). It will change drastically the demand

profile even prior to going into effect on January 1, 2020 because ports

and shippers are already preparing for the arrival of this new standard.

Essentially, 3 million barrels per day of high Sulphur fuel oil (HSFO)

demand that was for shipping will disappear once the rule goes into

effect. We anticipate that this no longer needed HSFO will be replaced

with low Sulphur substitutes like Marine Gas Oil and other proven

distillate blends, as shippers will not want to risk damaging their engines

with unproven grades of fuel blends. And we suspect that changes in

prices (due to these changing demand profiles) will incent refiners to adjust

their yields.

Make no mistake on our simplification of Platts Analytics

observations, this is an extremely convoluted series of adjustments that

is about to happen across the refining complex. And it is our opinion that

these multifaceted gyrations will have an aggregate favorable impact

on light sweet crude demand in the months ahead.

This is article is from S&P Global Platts RADAR, July 17, 2019 issue.

Call 800-371-0083 to request a sample copy.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT