Source: S&P Global Platts RADAR, January 31, 2019

S&P Global Platts, Senior Analyst, Trey Cowan

In East Texas, idioms like “taking someone to the woodshed” are common. And it would be easy to just associate the phrase with punishment doled out to a child. However,while not trying to sound like a William Safire devotee on the subject, the term has a little more depth to it. By giving the location of where the punishment occurs, this idiom is actually suggesting that the punishment is given discreetly away from view (i.e. not in public).

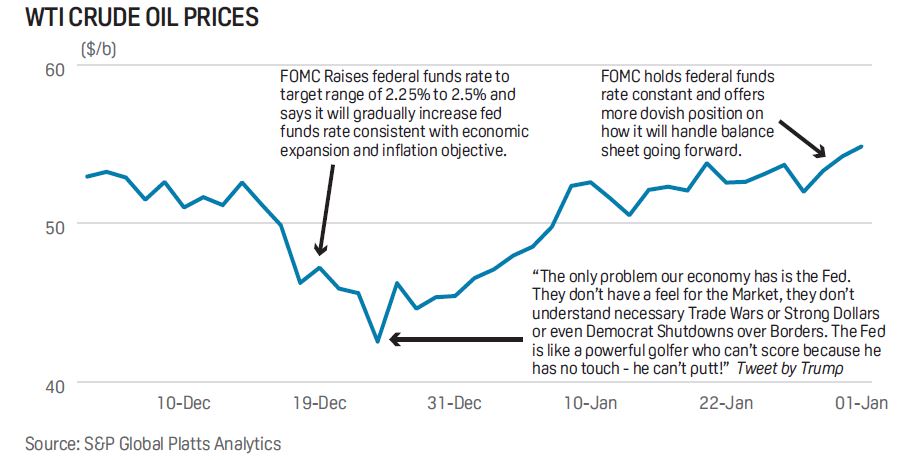

So, it is probably a huge understatement to say that President Trump is not known for following this strategy when criticizing his peers. Are you are wondering at this point what this has to do with the oil and gas industry? Well, a few weeks back Trump lit into the Federal Reserve Chair, Jerome Powell, on Twitter. Quite the opposite of punishing in private, Trump let the whole world know his ill feelings about how the Fed, and Powell specifically, were being too tight with US monetary policy.

FREE TRIAL OFFER

Receive a free one month trial of Platts Rigs and Drilling Analytical Report (RADAR). Each week you'll receive the latest analysis of unconventional activities and trends in the upstream market. Operators are categorized by major shale plays and unconventional formations. Plus, you'll have analysis of the drilling contractors involved by play with details on utilization, footage and market share. Available in both pdf and Excel format.

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

Shortly after Trump’s Twitter postings on the subject Powell’s posture changed. Whether or not Powell’s softening on the matter (i.e. US interest rate policy and the management of debt on the Fed’s balance sheet), was due to data-related observations or appeasing President Trump is up for debate. But it is worth noting that Powell explicitly said in an interview that the Fed’s stance was not influenced by politics. However, what is not up for debate is that the market welcomed this change and is in fact bullish on crude oil prices at the moment.

Further to the point, this week Federal Reserve Chairman Powell said that the FOMC

would not continue its policy of allowing its balance sheet runoff to go on autopilot and

is now “prepared adjust any of the details for completing balance sheet normalization in

light of economic and financial developments.” So, in addition to not raising interest rates, the Fed has also reversed course on how it handles the amount of US debt on its books. Its higher debt levels are generally thought of as being looser and less restrictive monetary policy that is positively stimulating the markets. Emerging markets and oil prices both tend to prosper more in such an environment because loose US monetary policy is generally accompanied by a weaker US dollar relative to foreign currencies. So, the recent bid underneath crude prices is a signal that market is now anticipating the effect that a weaker dollar has on oil prices and the better outlook for emerging markets, which will now have more to spend on raw materials (like crude oil) as a weaker dollar makes these goods relatively cheaper, thus improving the global demand outlook for crude.

This is an excerpt from S&P Global Platts RADAR, January 31, 2019 issue.

Call 800-371-0083 to request a sample copy.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

FREE TRIAL OFFER

Receive a free one month trial of Platts Land Rig Newsletter (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT