Source: RADAR | August 17, 2017 | Bob Williams, Director of Content

Source: RADAR | August 17, 2017 | Bob Williams, Director of Content

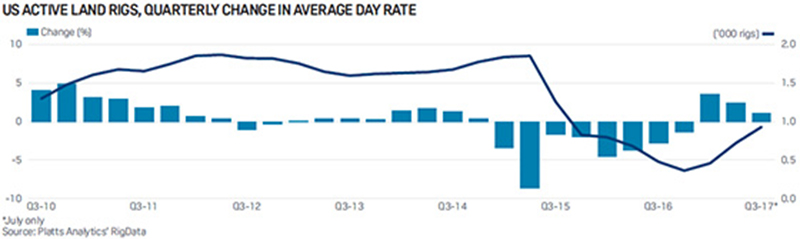

“Tapping the brakes” is as good a description of what’s happening in US land drilling activity today as any, and it applies to drilling costs as well.

Since the recovery in drilling activity began to really gather steam last December, the US active land rig count, as monitored by Platts RigData’s RADAR report, had added at least 40 rigs to each successive month’s average tally through May.

Correspondingly, there was a comparable run-up in rig day rates (the daily cost to hire a rig with a full crew). The turnaround in day rates began somewhat modestly, if unexpectedly, in December. Even with this monthly improvement, however, it wasn’t enough to lift the average day rate for 4Q 2016 out of negative territory, where it had languished for two years.

But Q1 of this year provided the jaw-dropper: a whopping 3.5% increase in the average day rate—the biggest quarter-to-quarter increase in this metric since 4Q 2010.

The driver for much of this surge was a shift in operator-driller negotiations on rig day rates: As operators scrambled to lock in day rates on the spot market before they could escalate further, drillers shifted from offering discounts for longer-term contracts to asking for premiums for same—especially for the preferred Class D (1,500–1,999 hp) rigs that now account for 70% of all US onshore drilling activity.

However...

To continue reading The Barrel blog, please visit this link...