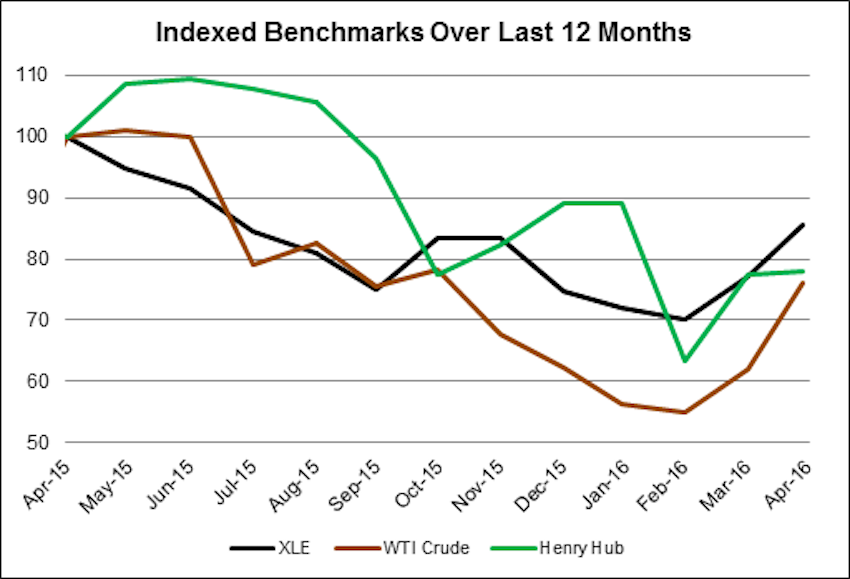

Stock markets appear to be pricing in a recovery for oil and gas producers, even though the US active land rig count continues to decline, according to an analysis published in a recent issue of RigData’s RADAR Report. While still down -14% over the last 12 months, the XLE (also known as the Energy Select Sector SPDR Fund) has performed better than the US benchmark prices for oil and natural gas (i.e., WTI crude -24%, Henry Hub -22%). The stock performances of majors ExxonMobil and Chevron, which account for about one-third of the XLE’s movement, are currently trending better than the XLE index itself.

Call 1-800-627-9785 to subscribe to RigData’s RADAR Report, the leading statistical monitor of overall land rig market activity and drilling trends by region, play, operator, driller, and many other proprietary metrics.