Source: Platts RigData RADAR Report published October 6, 2016

Source: Platts RigData RADAR Report published October 6, 2016

How Permian Stacks up Against Peers

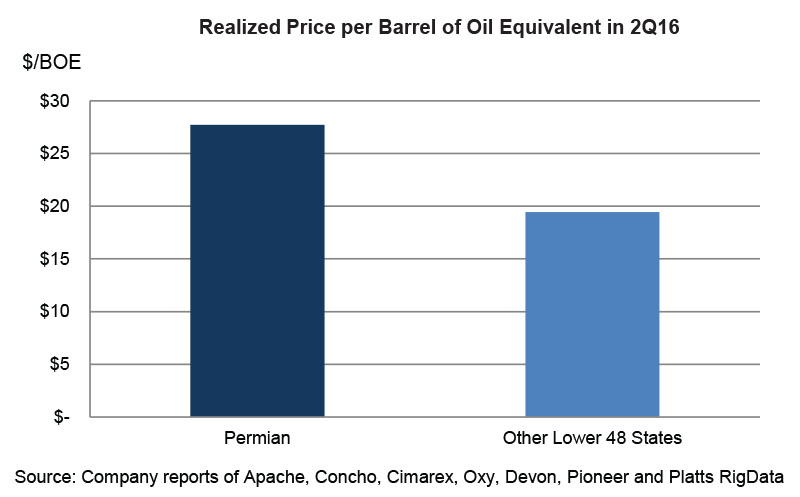

Each barrel of daily production from the Permian is valued at 54% more than the average production from other reservoirs spanning the Lower 48 states. This factor alone accounts for why debt has fallen in the Permian as a percentage of total valuations but has not changed in absolute terms.

The contrast is likely due to the better realized prices the Permian continues to maintain relative to other areas. At present a barrel of Permian production is selling for a $7.28 premium per barrel relative to the rest of the United States. We would expect this difference in pricing to continue attracting more rigs to the Permian Basin away from plays with poorer well economics.

To read the complete article from our RADAR report, contact customer service at 800-371-0083.