Source: S&P Global Platts Analytics, Bob Williams, Director of Content

With all the talk about sanctions and conflict and nationwide implosions, are stakeholders overlooking a potential “sleeper cell” for the oil market: DUCs?

Many observers are wondering, with oil prices topping $70/bbl and flirting with $80/ bbl, why aren’t US producers drilling more wells to capitalize on commodity revenue gains. A good deal of that perception is based in a short-sighted fixation that rig count = more wells = more production. As we have often reiterated, focusing on rig count without context becomes misleading.

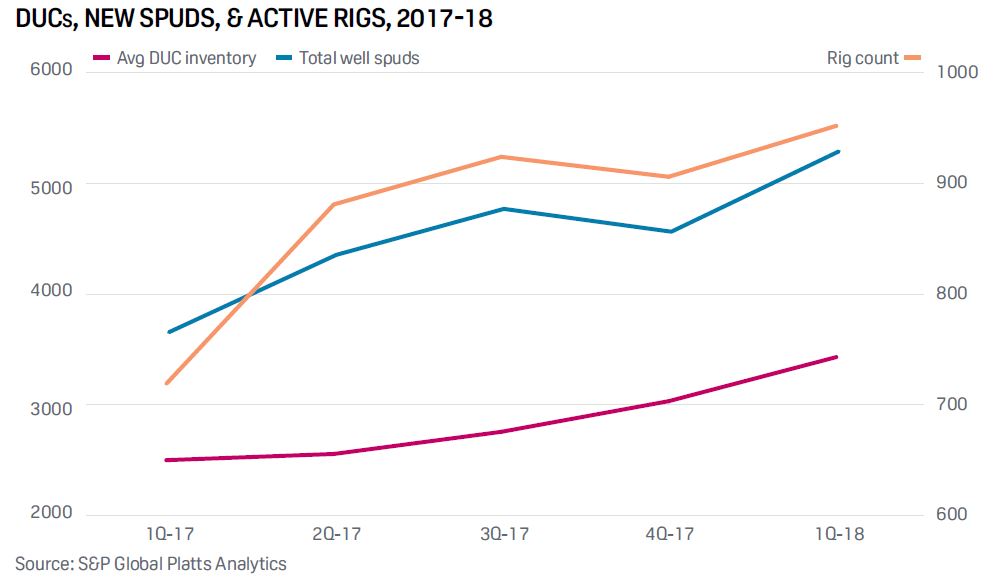

Last year, US land rig counts spiked by 56% in 1H 2017 in the light of oil prices climbing from about $47/bbl to $50/bbl, or 6%. The rig tally gained just another 14% in 2H 2017, as oil prices rose another 4%.

But many more wells were spudded, as new wells drilled increased by 17% in a comparison of last year’s 2 halves. While active rigs hit the “Big Stall” in 2H 2017, averaging 924 rigs in Q3 and 906 rigs in Q4, oil prices rose by another 4%. Of course, we now recognize the “Big Stall” as the “Circumspection Epiphany”— operators high-grading prospects for the best return instead of drilling mainly for growth’s sake, even with oil prices up an average 19% YOY.

But that was $20/bbl ago. And now with some investment banks talking about $80/ bbl+ this year, the quarterly average rig count through the first quarter of this year is up by just 4% compared with the 2H 2017 average tally, while oil prices ratcheted up another 21%. The rig count boom is more of a boomlet so far.

With pad-capable 1,500hp AC rigs continuing to expand their market dominance, their consequent greater efficiencies helped the number of new well spuds rise by 13% in Q1 of this year vs. 2H 2017’s average, to top 5,000 for the first time since 1Q 2015.

But many of those wells were not completed. The number of drilled but uncompleted (DUC) wells rose steadily throughout the period—not by as much as the number of new wells spudded, or 37% vs. 45%—but by more than the rig count gain of 32%. (A caveat: The data for DUCs lags the well and rig counts because of the nature of the data.)

Change in focus

The new DUC numbers also reflect a boom of more than 80% in Bakken DUCs in the early part of this year, evidence that Bakken drilling is spreading outside the sweet spots and that defrayed completions there are pending better well economics.

With that said, we see oil production growth largely unfettered. US oil output increased by another 6% YOY in 2017 vs. 2016 and has risen by another 14% in Q1 of 2018 vs. 2017’s overall average.

The nearby chart shows that the number of wells per rig and the proportion of growth in the DUC inventory relative to those new wells both inched up fairly steadily in the past 5 quarters; however, both were substantially outpaced by the rate of increase in crude production.

It suggests that even with the “Circumspection Epiphany,” US operators cannot help but boost crude production. As other maturing tight oil plays follow the Bakken’s lead, we could see DUCs grow further even with modest gains in rig counts. While that might flatten the production growth curve a bit, it increases the overhanging potential of added oil supply in the US, which may by itself help rein oil price spikes in an increasingly volatile world.

For more details on rig market share trends, utilization rates and breakouts by shale play call 1-800-627-9785 or email to CustomerService@rigdata.com to subscribe to Platts RADAR, the leading oil and gas industry publication focused on unconventional drilling activity and general trends in the U.S. oil and gas market.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email customerservice@rigdata.com or call 800-371-0083.