Source: S&P Global Platts Analytics

How Private Companies' Role in US Land Drilling is Changing

The US land rig count, per Rigs and Drilling Analytical Report (RADAR) methodology, has topped 1,000 again for the second time in six weeks. It is the highest tally for this metric since March 6, 2015. At a gain of 21 units, this is the largest sequential increase for the land rig count since January’s first count showing a jump of 36.

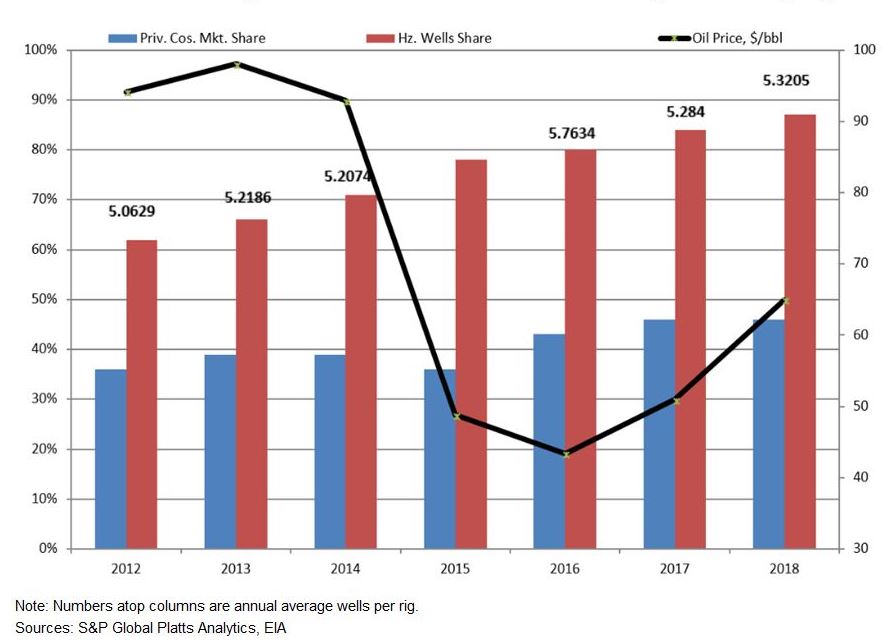

What makes this remarkable is the context of an oil price. NYMEX crude for prompt delivery averaged $65/bbl in Q2, increasing by $9, or 9%, vs. Q1; more importantly, NYMEX oil in 2018 through May is valued higher by 27% over the same 5 months in 2017.

Much higher oil prices yielding just one-fifth of the rig count increase, the RADAR analysts noted, and yet US crude oil production for the 5-month period is up 1.35 million, or 15%, YOY.

FREE TRIAL OFFER

Receive a free one month trial of RADAR (4 issues). Each week you'll receive the latest analysis of unconventional activities and general trends in the upstream market. Operators are categorized by the major shale plays and unconventional formations where activity is occurring. Plus, you'll see the drilling contractors involved by play with details on utilization, footage and market share. (Available in pdf and Excel format.)

Call 800-371-0083 or email CustomerService.RigData@spglobal.com.

Mention code 7HHONRPT

The other milestone is that the rig count share of private companies has topped 500 rigs for the first time since January 2015, at 503. Their market share is the highest it’s been since RADAR started tracking this cohort in 2008. For both all of 2017 and 2018 to date, the average share for each period has been 46%. But that metric has climbed further, to 48% in Q2 to date.

This time, for small private companies, the focus was on horizontal well. And like the new mantra among larger independents, stakeholders wanted to focus on the return of each well rather than growth for growth’s sake.

Upstream Activity Data for North America

For more information on North American upstream activity including permitting, drilling activity, production and completion data please contact S&P Global Platts via email CustomerService.RigData@spglobal.com or call 800-371-0083.